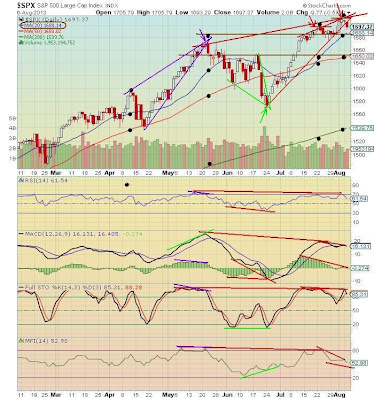

The indicators show universal negative divergence across the three-month and near-term time frames. This chart was highlighted on the weekend where it was unknown if the RSI would make new highs, and it did not, instead rolling over. Watch to see if the RSI drops under 50% today since that will indicate continued bearish markets ahead. The SPX lost the lower red trend line yesterday. It is about five weeks since price kissed the 20-day MA, which is now at 1688.14, so it would be prudent for price to test this support. The black dots show the price extension above the 20 MA above the 50 above the 200, when its time to revert to the mean. The brown lines show a potential H&S developing with head at 1710, neck line at 1680-1685, so the target is the 1650's if the 1680-1685 area fails, however, the H&S will need a right shoulder. Thus, price may come down to the 1680-1685, bounce, form the right shoulder at perhaps 1695-1705, then collapse down through the neckline.

The money flow is weak and bleak with lower lows now printing. Watch to see if the RSI takes on a weak and bleak profile today. Price should back test the 20 MA and/or 50 MA so the projection is sideways to sideways lower moving forward. This information is for educational and entertainment purposes only. Do not invest based on anything you read or view here. Consult your financial advisor before making any investment decision.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.